If you can master the art of patience and follow your day trading rules, it can be a real game-changer for your trading. Those are the 6 secrets you need to know to master day trading. There will be 6 secret tips in this article, and some of them have been compiled by the best traders that I have met and learned from.

Options Trading for Beginners – Investopedia

Options Trading for Beginners.

Posted: Sat, 25 Mar 2017 20:09:23 GMT [source]

Next, you need to decide if you are going to base your trading decisions on technicals (stock charts) or fundamentals (financial reports). If you are looking to place trades infrequently, meaning less than 3 per week, then a standard account will do. This means you are trading with only the cash you have on hand and are not looking to go short. You will have enough information to know how to learn trading and where to go deeper, but not enough to start placing trades. I will provide links to additional resources across the web and articles on TradingSim that will help you with this journey. Also, be sure to read this article on the best day trading platforms.

How to Research Stocks

This creates opportunities to profit from changes that may increase or reduce one currency’s value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen. Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed. A trader can buy or sell currencies in the forward or swap markets in advance, which locks in an exchange rate. An interesting aspect of world forex markets is that no physical buildings function as trading venues.

That match is free money and a guaranteed return on your investment. In fact, with so many investments now available to beginners, there’s no excuse to skip out. And that’s good news, because investing can be a great way to grow your wealth.

When people talk about the forex market, they are usually referring to the spot market. You’ll often see the terms FX, forex, foreign exchange market, and currency market. These terms are synonymous, and all refer to the forex market. Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk.

Day traders also like stocks that are highly liquid because that gives them the chance to change their position without altering the price of the stock. If a stock price moves higher, traders may take a buy position. If the price moves down, a trader may decide to sell short so they can profit when it falls. Day trading means buying and selling a batch of securities within a day, or even within seconds.

Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance. For example, breakouts that occur during the first hour of regular trading hours and are accompanied by increased volume, have a very high probability of seeing follow-through.

Some brokers charge no trade commissions at all, but they make up for it with other fees. Diversification is an important investment concept to understand. You could think of it as financial jargon for not putting all of your eggs in one basket.

That means when you’re sitting at your desk, staring at your monitors with hands dancing across your keyboard, you’re looking at the best sources of information. A momentum trader could buy on the announcement, or in anticipation of the announcement, and ride the trend until it exhibits signs of reversal. Equipped with 30 built-in indicators, more than 2,000 free custom indicators, plus 700 paid options, the user-friendly terminal has plenty for newbies to test out. MetaQuotes also offers a host of video tutorials and tips for those getting to grips with the platform.

What are the different types of stocks?

Scheduled announcements such as the release of economic statistics, corporate earnings, or interest rate announcements are subject to market expectations and market psychology. That is, markets react when those expectations are not met or are exceeded—usually with sudden, significant moves which can greatly benefit day traders. There was a time years ago when the only people able to trade actively in the stock market were those working for large financial institutions, brokerages, and trading houses. The arrival of online trading, along with instantaneous dissemination of news, have leveled the playing—or should we say trading—field. That said, market reaction to such fundamental data should be monitored by day traders for trading opportunities that can be exploited using technical analysis. These days, the market is volatile, and you need to know how to ride the waves and navigate the changing tides.

Every trader has to start somewhere, including day traders. With that said, intraday trading is difficult, so novice investors should be prepared for a steep learning curve. Take the time to research and understand the financial markets that you are interested in and develop a suitable strategy before investing money. When investing, a good rule of thumb is not to put all of your eggs in one basket. By spreading your dollars across various investments, you can reduce investment risk. In addition to knowledge of day trading procedures, day traders need to keep up with the latest stock market news and events that affect stocks.

Types of Markets

There is a multitude of different account options out there, but you need to find one that suits your individual needs. Following a straightforward trend is a good place to start when you are learning how to day trade. Many beginners prefer these modern and clutter-free terminals. Binaries are available on a range of popular markets and contracts can last from just 5 seconds, providing plenty of opportunities throughout the trading day. A useful pointer when you begin day trading is to focus on one market. Learn how the value of gold, for example, reacts throughout the day to news or wider industry trends.

Next, understand that Uncle Sam will want a cut of your profits, no matter how slim. Remember that you’ll have to pay taxes on any short-term gains—investments that you hold for one year or less—at the marginal rate. As a beginner, focus on a maximum of one to two stocks during a session. Tracking and finding opportunities is easier with just a few stocks. Recently, it has become increasingly common to trade fractional shares.

Day Trading For Beginners: 6 Secrets

Day traders use any of a number of strategies, including swing trading, arbitrage, and trading news. They refine these strategies until they produce matrix organizations are really a combination of the consistent profits and limit their losses. Individuals who attempt to day-trade without an understanding of market fundamentals often lose money.

- By investing, you can better combat inflation, increasing your chances of being able to afford the same amount of goods and services in the future that you can today.

- This article is centered around stock trading for dummies obviously, but once you start trading other product types will be made available to you.

- These stocks are often illiquid and the chances of hitting the jackpot with them are often bleak.

- Also, this person will need to provide you emotional support during low times and act as a reality check when things start to go well.

- On the other hand, if you’re investing for a short-term goal — less than five years — you likely don’t want to be invested in stocks at all.

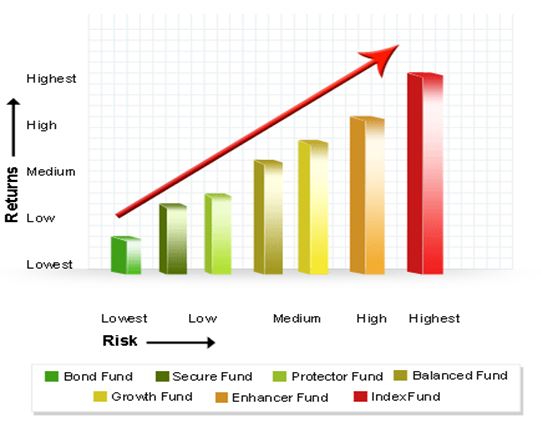

- Further, it would likely produce returns that match that of an index fund.

Unless you see a real opportunity and have done your research, steer clear of these. If you invest the money you earn with your share investments repeatedly, you receive interest on it again and again. In the beginning, this effect is limited, but over a long period of time the effect increases enormously. Aside from the news, it is also important to try to spot patterns.

Forex for Hedging

There is no minimum to open an Acorns account, and the service will start investing for you once you’ve accumulated at least $5 in round-ups. Index funds can have minimum investment requirements, but some brokerage firms, including Fidelity and Charles Schwab, offer a selection of index funds with no minimum. That means you can begin investing in an index fund for less than $100.

- Finally, day trading involves pitting wits with millions of market pros who have access to cutting-edge technology, a wealth of experience and expertise, and very deep pockets.

- The trader has reason to believe that this is going to be one of those days.

- Index funds can have minimum investment requirements, but some brokerage firms, including Fidelity and Charles Schwab, offer a selection of index funds with no minimum.

When you invest in stocks, you’re hoping the company grows and performs well over time. Before you start day trading, it is also important to understand any tax requirements in your https://1investing.in/ local jurisdictions. It can feel overwhelming when newbies start day trading, with an extensive range of charts, pricing structures and platform options to get your head around.

The key point to remember is that the only performance you need to worry about is your own. Do not start counting another trader’s money or winning percentage. Now, this mentor needs to be someone that has a proven track record trading and are not in it to just sell you a course. You can find mentors by following the top traders on StockTwits, speaking to other traders or doing a search on the web.

Established online brokers such as Charles Schwab have added robo-like advisory services. According to a report by Charles Schwab, 58% of Americans say they will use some sort of robo-advice by 2025. It can be difficult to diversify when investing in individual stocks if your budget is limited.

Most day traders will end up losing money, at least according to the data. But, with experience, your chances of succeeding can grow. Assess and commit to the amount of capital you’re willing to risk on each trade.

Leave a reply