The technique has proven to be very useful for finding positive surprises. Despite falling global prices for solar modules, Thakkar said he sees First Solar (FSLR) steadily building sales volumes at ASPs closer to what it has recently achieved. First Solar Inc said on Tuesday that renewable energy firm Longroad Energy has increased the orders for the company’s solar panels by 2 gigawatts (GW), taking Longroad’s total procurement to about 8 G… The First Solar stock recently publicized its Q2 earnings report on July 27th, 2023.

The company was founded by Michael J. Ahearn in 1999 and is headquartered in Tempe, AZ. The increasing global demand for clean energy solutions presents a favorable market environment for the company. First Solar is well-positioned to capitalize on this trend by expanding its product offerings, entering new markets, and pursuing strategic partnerships and acquisitions. However, the interest seemed to be cooling down with time and we saw several renewable energy stocks move sideways recently.

Private Companies

Some of First Solar’s key customers include major utilities, such as Southern Company, Dominion Energy, and NRG Energy. First Solar, Inc. is a solar technology company, which engages in the provision of solar modules. It is involved in the design, manufacture, and sale of cadmium tellurid (CdTe) solar modules, which convert sunlight into electricity.

The company must continue to invest in research and development, innovation, and operational efficiency to stay ahead of the competition. First Solar’s leadership team comprises highly experienced professionals with diverse backgrounds and expertise. Mark Widmar is the Chief Executive Officer, leading the company’s strategic direction and operations. Widmar brings extensive experience in the renewable energy industry, having held various executive positions within First Solar since joining the company in 2006.

First Solar’s focus on sustainability and environmental stewardship is a mitigating factor against potential risks. By promoting clean energy solutions and minimizing its environmental footprint, the company aligns itself with the growing demand for sustainable practices and mitigates reputational risks. The ongoing development of energy storage technologies presents an opportunity for First Solar to enhance its integrated PV power systems and offer comprehensive energy solutions. By combining solar generation with efficient storage capabilities, the company can address the intermittent nature of solar power and provide a more reliable and stable energy supply. The company has achieved several significant milestones and received industry recognition for its contributions to the renewable energy sector.

Vandita Jadeja is a CPA and a freelance financial copywriter who loves to read and write about stocks. Her knowledge of words and numbers helps her write clear stock analysis. The company benefits from its presence in both the utility and renewable sectors. The stock is down 18% year to date and this drop makes it a solid chance to make your move.

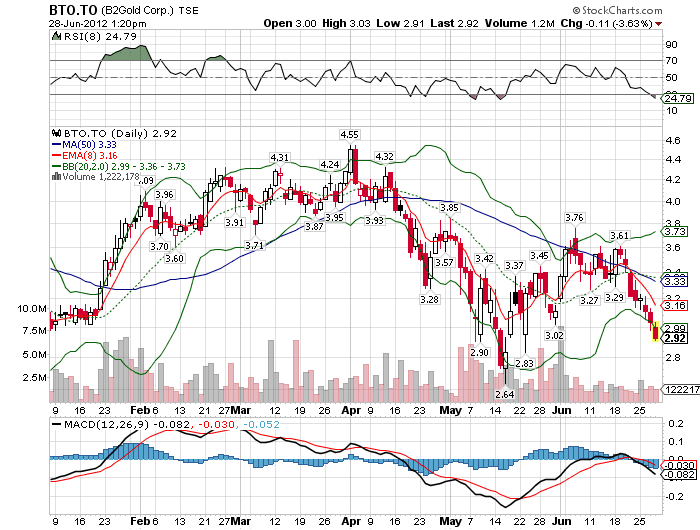

Stock Price Targets

And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. First Solar experienced a decline in its earnings at a rate of 32.7% per year on average, according to Simply Wall St. The semiconductor industry’s average annual earnings growth is 31.4%. Therefore, First Solar earnings are slightly higher than the industry average. After, a positive return the stock invited profit booking, and the price still declined from the trendline showing that the selling strength is tremendous and pointing to more upcoming falls on the charts.

First Solar’s valuation remains favorable compared to industry peers, reflecting investor confidence in the company’s prospects. First Solar specializes in designing, developing, and manufacturing advanced thin-film PV modules and providing integrated PV power plant solutions. By leveraging its PV technology and system integration expertise, the company aims to enable a sustainable https://1investing.in/ energy future by delivering reliable, cost-effective solar power solutions. First Solar’s mission statement reflects its dedication to providing clean energy and promoting a greener planet. High-growth stocks tend to represent the technology, healthcare, and communications sectors. They rarely distribute dividends to shareholders, opting for reinvestment in their businesses.

Get this delivered to your inbox, and more info about our products and services. One share of FSLR stock can currently be purchased for approximately $176.10. 182 employees have rated First Solar Chief Executive Officer Mark Widmar on Glassdoor.com. Mark Widmar has an approval rating of 96% among the company’s employees. This puts Mark Widmar in the top 30% of approval ratings compared to other CEOs of publicly-traded companies. 75.0% of employees surveyed would recommend working at First Solar to a friend.

First Solar CEO: New facility plans driven by high demand and backlog

First Solar recently commenced production at its manufacturing plant in India. Please note that all recommendations are based on our model’s results and do not represent our personal opinion. Sign-up to receive the latest news and ratings for First Solar and its competitors with MarketBeat’s FREE daily newsletter. The industry with the best average Zacks Rank would be considered the top industry (1 out of 265), which would place it in the top 1% of Zacks Ranked Industries. The industry with the worst average Zacks Rank (265 out of 265) would place in the bottom 1%.

The company issued revenue guidance of $3.4-$3.6 billion, compared to the consensus revenue estimate of $3.49 billion. Style is an investment factor that has a meaningful impact on investment risk and returns. Style is calculated by combining value and growth scores, which are first individually calculated. The future is renewable energy and whether you believe in it or not, the world is gearing up to be a cleaner and greener place.

Markets News, Sept. 6, 2023: Nasdaq, S&P 500 Tumble as Oil … – Investopedia

Markets News, Sept. 6, 2023: Nasdaq, S&P 500 Tumble as Oil ….

Posted: Wed, 06 Sep 2023 07:00:00 GMT [source]

These returns cover a period from January 1, 1988 through July 31, 2023. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations.

Markets Brief: Why Your Portfolio Might Need Stocks With High Cash Flows

The company’s share price has experienced notable upward movements, reaching all-time highs during favorable industry conditions and strong earnings announcements. First Solar, Inc. is a leading global provider of comprehensive photovoltaic (PV) solar energy solutions. Headquartered in Tempe, Arizona, the company has a strong presence in North America, Europe, and Asia. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.32% per year.

It has production lines in Vietnam, Malaysia, the United States, and India. With impressive product offerings and a solid cash flow, there is a lot lined up for SolarEdge. It is a pure-play solar stock that is benefiting from government policies and enjoying solid growth. With the revenue growing steadily since 2016, the company is in the perfect position to make the most of the growth of the solar sector. While First Solar operates in a promising industry, it faces several risks and challenges. One significant risk is the potential impact of regulatory changes and policy shifts.

- It is expanding at a rapid pace and will have the fifth U.S. manufacturing facility opened by 2026.

- The company benefits from its presence in both the utility and renewable sectors.

- It is a pure-play solar stock that is benefiting from government policies and enjoying solid growth.

- Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams.

Compare

FSLR’s historical performance

against its industry peers and the overall market. Morningstar analysts hand-select direct competitors or comparable companies to

provide context on the strength and durability of FSLR’s

competitive advantage. The 14 SMA is below what is an expatriate the median line at 43.23 points which indicates that the FSLR stock is in a bearish territory and both lines are moving closely. However, if it maintains the current level, the FSLR price could continue to move upward and reach the first and second resistances of $183 and $193.

The factors driving First Solar’s valuation include its strong track record of financial performance, innovative PV technology, and its position as a market leader in the solar energy industry. The increasing demand for clean and sustainable energy solutions has fueled investor interest in First Solar, as the company is well-positioned to capitalize on the global shift towards renewable energy. The renewable energy industry, particularly the solar energy sector, has grown significantly in recent years. The increasing global focus on reducing carbon emissions and combating climate change has propelled the adoption of renewable energy sources, including solar power. First Solar operates in a highly competitive market alongside other solar energy companies. First Solar’s stock performance has been impressive in recent years, reflecting its solid financial results and positive market sentiment.

They have high upside potential since the anticipated shift towards renewable power is underway and we will see renewable energy companies raking in big numbers in the next few years. There will be steady growth in this sector and now is the time to invest in the most undervalued renewable energy stocks. 23 Wall Street equities research analysts have issued “buy,” “hold,” and “sell” ratings for First Solar in the last twelve months. The consensus among Wall Street equities research analysts is that investors should “moderate buy” FSLR shares. Furthermore, changes in consumer preferences and market dynamics could impact the adoption of solar energy solutions. First Solar must remain attuned to evolving customer needs and preferences to ensure its products and services remain relevant and competitive.

First Solar (FSLR) to Supply Solar Modules to Longroad Energy – Nasdaq

First Solar (FSLR) to Supply Solar Modules to Longroad Energy.

Posted: Wed, 13 Sep 2023 11:37:00 GMT [source]

Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. However, like any publicly traded company, First Solar is not immune to market volatility. Monitoring the stock’s performance and staying informed about relevant news and events is essential for investors and stakeholders. First Solar is a key player in the renewable energy industry, focusing strongly on utility-scale solar power plants. The company has successfully delivered numerous large-scale PV installations worldwide, contributing to the global adoption of solar energy.

Changes in government incentives, subsidies, or trade policies could influence the economics of solar energy projects and affect the demand for First Solar’s products and services. I believe NextEra has the potential to keep growing in the coming years and if the demand for power rises, it is set to make the most of it. NEE is one stock that is set to benefit the most from the transition towards renewable energy.

Therefore, if the FSLR price fails to sustain the current level and decreases, it might hit the nearest support levels of $171 and $160. First Solar has a debt-to-equity ratio of 7.2%, as reported by Simply Wall St., a financial website. This implies that it has less debt than equity, which is the difference between its total assets of $9 Billion and total liabilities of $2.96 Billion. The company has a backlog of 77.8 gigawatts which will continue to drive business throughout this decade. It is expanding at a rapid pace and will have the fifth U.S. manufacturing facility opened by 2026.

How has FSLR performed historically compared to the market?

This site is protected by reCAPTCHA and the Google

Privacy Policy and

Terms of Service apply.

First Solar has maintained a healthy balance sheet, with enough assets to cover long-term debt. The company’s debt levels have remained relatively stable, allowing it to invest in research and development, expand production capacity and pursue strategic initiatives. Zacks Earnings ESP (Expected Surprise Prediction) looks to find companies that have recently seen positive earnings estimate revision activity.

The largest electric utility holding firm, NEE reported impressive financials in the recent quarter. It saw a 100% jump in net income to reach $2.8 billion and the net income in the renewable energy sector increased by over 10 times. The company also added 1,665 megawatts of new renewables and projects to the backlog. Dividend yield allows investors, particularly those interested in dividend-paying stocks,

to compare the relationship between a stock’s price and how it rewards stockholders through dividends. The formula for calculating dividend yield is to divide the annual dividend paid per share by the stock price.

Shares of First Solar surged on Monday after agreeing to provide solar modules to Israel-based renewable energy firm Energix Renewables. The revenue came in at $991.3 million and the solar segment revenue hit $947.4 million. SEDG stock is down 53% in the past six months and smart investors know that now is the time to snap up the stock.

The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season. As an investor, you want to buy stocks with the highest probability of success. That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style. FSLR, +0.70% were moving more than 6% higher in Thursday’s aftermarket action after the solar-technology company easily cleared expectations with its second-quarter results…. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams.

Leave a reply